Delve into the world of insurance in 2025 with a focus on bundling home and auto policies. This article aims to provide insights into the advantages, cost savings, and improved coverage options that come with bundling, offering a comprehensive look at this evolving trend.

Overview of Bundling Home and Auto Insurance

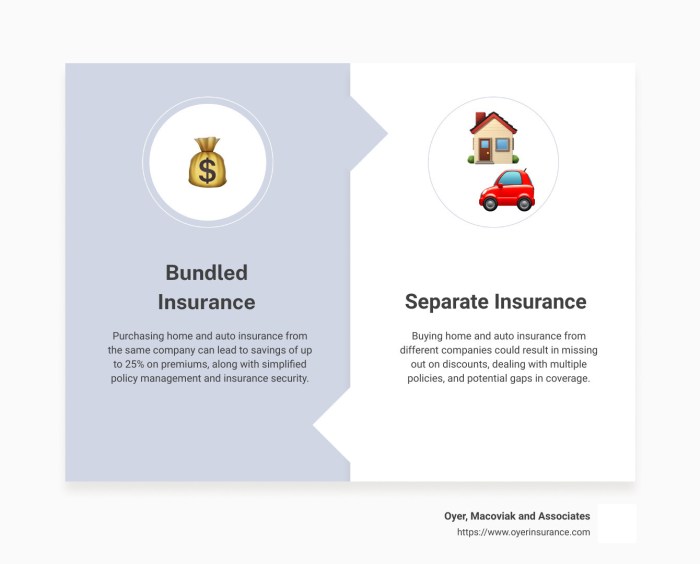

Bundling home and auto insurance refers to the practice of purchasing both your home insurance and auto insurance from the same insurance provider. This means consolidating your policies with one insurer instead of having separate policies with different companies.When you bundle your home and auto insurance policies, you are essentially combining them into a single package.

This not only makes managing your insurance easier but also often comes with various benefits and cost savings.

Advantages of Bundling Insurance Policies

- Cost Savings: Bundling your home and auto insurance can lead to significant cost savings. Insurance companies often offer discounts for customers who purchase multiple policies from them.

- Convenience: Having all your insurance policies with one provider can simplify the process of managing your insurance. You’ll only have to deal with one company for all your insurance needs.

- Streamlined Coverage: Bundling your policies can also help ensure that there are no coverage gaps or overlaps between your home and auto insurance. This can provide you with more comprehensive coverage overall.

- Additional Discounts: In addition to the initial discount for bundling, some insurance companies offer further discounts or perks for loyal customers who have multiple policies with them.

- Improved Customer Service: By bundling your policies, you may also benefit from improved customer service. Dealing with one company for all your insurance needs can make it easier to get assistance and resolve any issues that may arise.

Benefits of Bundling Home and Auto Insurance

When it comes to bundling home and auto insurance, there are several benefits that policyholders can enjoy.

Potential Cost Savings

One of the key advantages of bundling home and auto insurance is the potential cost savings it can offer. Insurance companies often provide discounts to customers who choose to bundle their policies together. By combining both home and auto insurance, policyholders can save money on their premiums compared to purchasing separate policies.

Convenience of One Policy

Having one policy for both home and auto insurance can greatly simplify the insurance process. Instead of managing multiple policies with different renewal dates and coverage details, bundling allows policyholders to have everything in one place. This makes it easier to keep track of payments, claims, and any changes to the policy.

Improved Coverage Options

Another benefit of bundling home and auto insurance is the potential for improved coverage options. Insurance companies may offer enhanced coverage or additional perks to policyholders who choose to bundle their policies. This can provide a greater sense of security and peace of mind knowing that both your home and auto are well-protected under a comprehensive insurance plan.

Trends in Bundling Home and Auto Insurance in 2025

In 2025, the insurance industry continues to witness evolving trends in the bundling of home and auto insurance policies. Technological advancements play a significant role in shaping these trends, influencing how insurance companies offer incentives and discounts to policyholders who choose to bundle their coverage.

Impact of Technology on Bundling Policies

Technology has revolutionized the way insurance companies operate, allowing for more personalized and efficient services. In 2025, the use of artificial intelligence and data analytics enables insurers to tailor bundled insurance packages to individual policyholders based on their specific needs and risk profiles.

This personalized approach not only enhances customer satisfaction but also helps insurers to better manage and mitigate risks, leading to more competitive pricing for bundled policies.

New Incentives and Discounts

Insurance companies are increasingly offering new incentives and discounts to encourage policyholders to bundle their home and auto insurance. In 2025, we see a rise in usage-based insurance programs that utilize telematics devices to track driving behavior, rewarding safe drivers with discounted rates on their bundled policies.

Additionally, insurers are introducing loyalty programs that provide long-term policyholders with exclusive discounts and benefits for bundling their coverage. These incentives aim to foster customer loyalty and retention while promoting safer driving habits among policyholders.

Consumer Considerations for Bundling Home and Auto Insurance

When deciding whether to bundle home and auto insurance, consumers should carefully weigh the pros and cons to ensure they are making the best decision for their specific needs and circumstances. By understanding the factors to consider and how to maximize the benefits of bundled insurance, consumers can make an informed choice that suits their financial and coverage requirements.

Factors to Consider When Bundling Insurance

- Cost Savings: Bundling home and auto insurance can often lead to discounted rates from insurance providers. Consumers should compare the total cost of bundled insurance versus separate policies to determine if there are significant savings.

- Coverage Needs: It’s essential to evaluate if the bundled policy offers adequate coverage for both home and auto insurance needs. Consumers should review the policy details and ensure it meets their requirements.

- Insurance Provider Reputation: Researching the reputation and customer service of the insurance provider is crucial. Consumers should choose a reliable company with a good track record of handling claims efficiently.

Tips to Maximize Benefits of Bundled Insurance

- Review Regularly: It’s important to review the bundled policy annually to reassess coverage needs and ensure the premium rates are still competitive.

- Ask About Discounts: Inquire with the insurance provider about additional discounts or ways to further reduce premiums by adding security features or increasing deductibles.

- Bundle Additional Policies: Consumers may consider bundling other insurance policies, such as life or umbrella insurance, with their home and auto coverage for additional savings.

Potential Drawbacks of Bundling Home and Auto Insurance

- Limitations on Choices: Bundling insurance may limit consumers’ ability to choose different providers for home and auto coverage, potentially restricting access to specialized policies or discounts from other insurers.

- Policy Changes: Changes to one aspect of the bundled policy, such as adding or removing coverage, can impact the entire policy, requiring careful consideration to avoid unintended consequences.

- Cancellation Complications: If a consumer decides to cancel the bundled policy, they may face complexities in transitioning to separate policies, potentially leading to gaps in coverage or higher premiums.

Final Wrap-Up

In conclusion, bundling home and auto insurance in 2025 offers a strategic approach to maximizing savings and coverage. As technology continues to shape the insurance landscape, embracing bundled policies can lead to a more streamlined and efficient insurance experience for consumers.

User Queries

What are the main benefits of bundling home and auto insurance?

Bundling can lead to cost savings, convenience of managing one policy, and improved coverage options.

How can consumers maximize the benefits of bundled insurance policies?

Consumers can maximize benefits by understanding their coverage needs, comparing different bundled options, and taking advantage of any discounts offered.

Are there any drawbacks to bundling home and auto insurance?

Potential drawbacks include limitations in coverage options or restrictions on certain policy features. It’s essential for consumers to review the details carefully.