Kicking off with Comparing Home and Auto Insurance Bundles: Are They Worth It?, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

The content of the second paragraph that provides descriptive and clear information about the topic

Overview of Home and Auto Insurance Bundles

When it comes to insurance, bundling home and auto coverage has become a popular option for policyholders looking to streamline their insurance needs. By combining both types of insurance with the same provider, individuals can often benefit from cost savings and added convenience in managing their policies.

Benefits of Bundling Home and Auto Insurance

- Cost Savings: One of the key advantages of bundling home and auto insurance is the potential for cost savings. Insurance companies often offer discounts to policyholders who choose to bundle their coverage, resulting in lower overall premiums.

- Convenience: Bundling home and auto insurance with the same provider can make it easier for individuals to manage their policies. With a single point of contact for both types of insurance, policyholders can streamline their communication and claims processes.

- Increased Coverage Options: Some insurance companies may offer enhanced coverage options or additional benefits to policyholders who bundle their home and auto insurance. This can provide added peace of mind and protection in the event of a claim.

Coverage Comparison

When comparing standalone home and auto insurance policies, it’s essential to understand the coverage options available in each and how bundling can enhance or provide additional benefits to policyholders.

Comparison of Coverage Options

- Standalone Home Insurance:

- Typically covers the physical structure of the home, personal belongings, liability protection, and additional living expenses in case of a covered loss.

- May offer optional coverage for specific risks like earthquakes or floods, depending on the location.

- Does not include coverage for personal vehicles or auto-related incidents.

- Standalone Auto Insurance:

- Provides coverage for damage to the insured vehicle, liability protection, medical payments, and uninsured/underinsured motorist coverage.

- May offer add-ons like roadside assistance, rental car reimbursement, and comprehensive coverage for non-collision incidents.

- Does not include coverage for the home or property-related claims.

Benefits of Bundling Policies

- Discounts: Insurance companies often offer discounts when bundling home and auto policies together, leading to cost savings for policyholders.

- Convenience: Managing one policy with the same insurer for both home and auto coverage can simplify paperwork and payment processes.

- Enhanced Coverage: Some insurers provide additional benefits or enhanced coverage options for policyholders who bundle their policies, such as increased liability limits or special endorsements.

Limitations of Bundled Policies

- Restrictions: Bundled policies may come with limitations on coverage options or restrictions on certain types of claims, especially if one of the bundled policies has unique requirements.

- Loss of Discounts: If one portion of the bundled policy is canceled or modified, it could result in the loss of the bundled discount, potentially increasing overall insurance costs.

- Less Flexibility: Policyholders may have less flexibility in customizing their coverage when bundling policies, as they are typically packaged together with predetermined features.

Cost Analysis

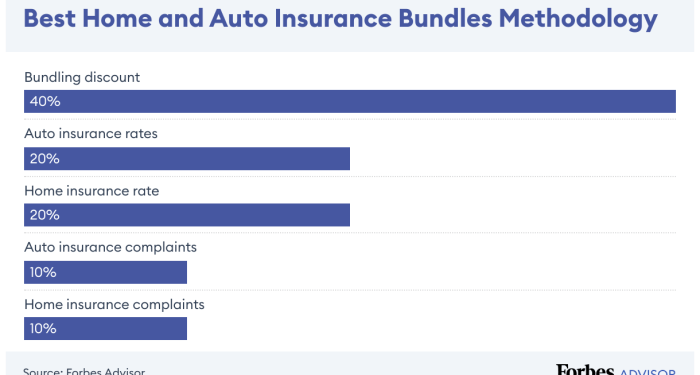

When considering bundling home and auto insurance, one of the key factors to evaluate is the cost savings associated with combining these policies. By understanding how discounts are applied and how premiums are calculated for bundled policies, you can make an informed decision on whether bundling is worth it for you.

Discount Application

When you bundle your home and auto insurance policies with the same provider, you typically receive a discount on both policies. This discount can vary depending on the insurance company, but it is common for insurers to offer savings ranging from 5% to 25% when policies are bundled together.

Premium Calculation

Insurance premiums are calculated based on a variety of factors, including the level of coverage, deductible amounts, and the risk profile of the policyholder. When bundling home and auto insurance, insurers often take into account the reduced administrative costs of managing multiple policies for the same customer.

This can result in additional savings that are passed on to the policyholder in the form of lower premiums.

Customization and Flexibility

When it comes to bundled home and auto insurance policies, one of the key benefits is the ability to customize the coverage to suit individual needs. Policyholders have the flexibility to tailor their insurance plans according to their specific requirements, providing a more personalized and comprehensive protection.

Customizable Coverage Options

- Policyholders can choose the level of coverage for both home and auto insurance based on their preferences and budget.

- Options such as adding extra coverage for valuable items in the home or selecting a higher liability limit for auto insurance can be easily included in a bundled policy.

- Customizable deductibles and limits allow policyholders to adjust their coverage to meet their unique circumstances.

Flexibility in Policy Bundling

- Policyholders have the flexibility to combine different types of coverage within the bundled policy, such as adding renters insurance or umbrella insurance for additional protection.

- Changes can be made to the bundled policy over time to accommodate life changes or new insurance needs, providing a versatile and adaptable insurance solution.

- Discounts and savings can be applied when bundling policies, making it a cost-effective option for those looking to customize their coverage.

Add-Ons and Endorsements

- Policyholders can enhance their bundled insurance policy by including add-ons or endorsements for specific needs, such as roadside assistance, identity theft protection, or extended coverage for high-value items.

- These additional features can be easily integrated into the bundled policy, offering a comprehensive and tailored insurance solution that meets the policyholder’s individual requirements.

- By adding endorsements or riders to the bundled policy, policyholders can ensure they have the right level of protection for their unique belongings or lifestyle.

Provider Options

When exploring home and auto insurance bundles, it’s crucial to consider the various insurance providers available in the market. Each provider offers different coverage options, pricing structures, and customer service experiences. Let’s delve into comparing different insurance providers that offer home and auto insurance bundles to help you make an informed decision.

Factors to Consider When Choosing an Insurance Provider

- Policy Coverage: Evaluate the types of coverage included in the bundle and ensure they meet your specific needs for both home and auto insurance.

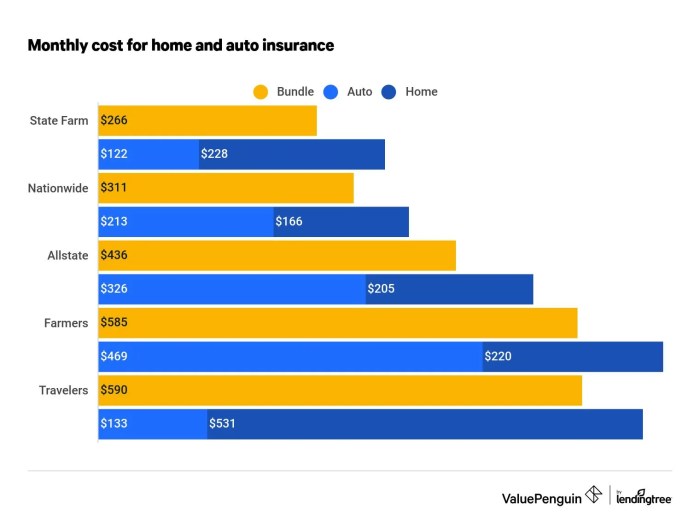

- Pricing and Discounts: Compare the overall cost of bundled policies from different providers and look for available discounts that can help you save money.

- Customer Service: Research the reputation of each insurance company in terms of customer service, responsiveness, and claims handling.

- Financial Stability: Consider the financial strength of the insurance provider to ensure they can fulfill their obligations in case of a claim.

Insights into Insurance Companies Offering Bundled Policies

- State Farm: Known for its extensive network of agents and personalized service, State Farm offers competitive home and auto insurance bundles.

- Progressive: With a user-friendly online platform and innovative pricing options, Progressive is a popular choice for bundled insurance policies.

- Allstate: Allstate provides customizable coverage options and a range of discounts for policyholders bundling their home and auto insurance.

- Geico: Geico is recognized for its affordable rates and convenient mobile app, making it a convenient option for customers seeking bundled insurance.

Last Recap

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Commonly Asked Questions

Are there any limitations to bundled policies?

Bundled policies may have restrictions on coverage options, so it’s essential to review the policy details carefully.

How are discounts typically applied when bundling home and auto insurance?

Discounts are usually automatically applied when you purchase both home and auto insurance from the same provider.

Can bundled policies be customized to individual needs?

Yes, bundled policies often offer customization options to tailor coverage to specific needs.